Mobile payment is a new and innovative business. Especially after the successful launch of RFSIM (which integrates payment chip into SIM card), it is foreseeable that mobile payment will become a milestone after electronic money. In the era of electronic money, replacing the wallets and various cards in the hands of urban people will directly subvert people's lives.

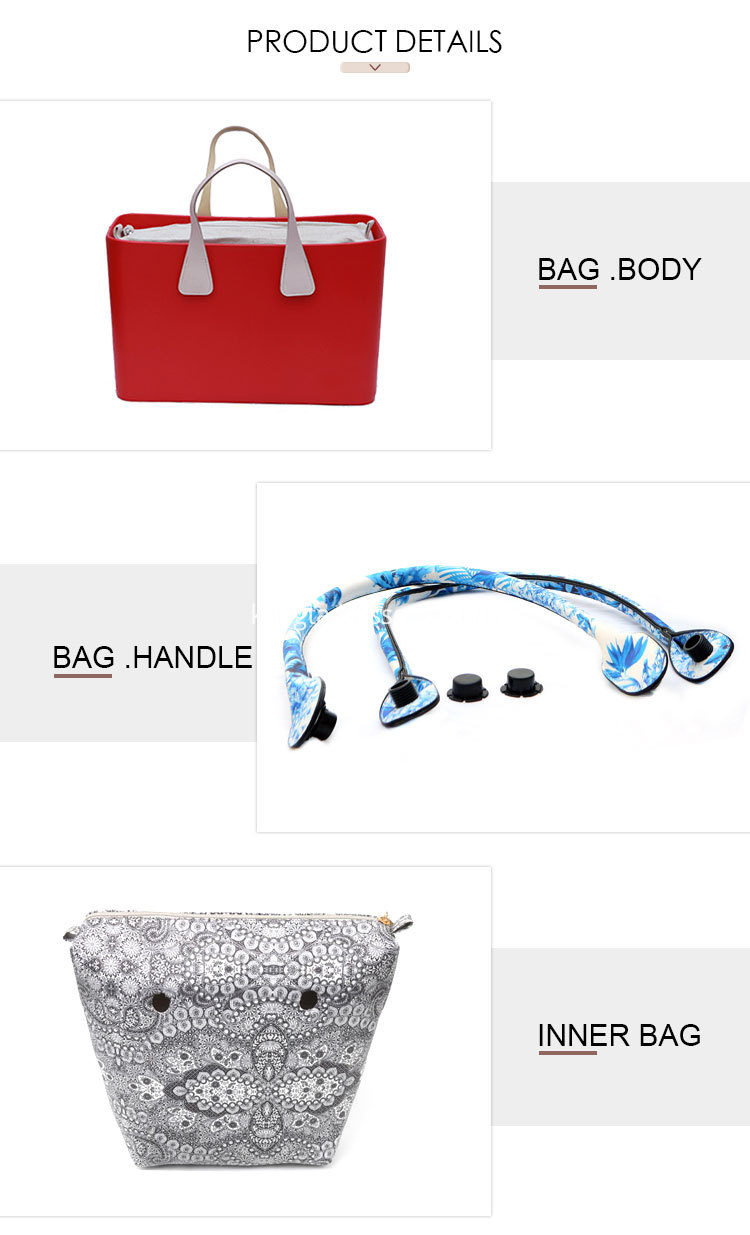

Kangta factory used to be O Bag factory in 2011&2012, O Bag City style was developed in 2017, it is made of EVA material, an expanded plastic material, colored, flexible, resistant and light, with particular 'soft touch' tactility which is cold-tolerant, heat-stable, acid and water resistance and very popular in O bag USA and O bag France.

Dimensions: 23cm in height, 38cm in width, 16cm in width, 38cm in length.

This kind of bag is now very popular in Italy, Europe, the USA, Poland, Germany, Mexico even South Africa, India, Japan, Korea, and many other countries, some customers would like to call the bags as " EVA beach bag/Pet Bag".

O Bag City EVA Beach Bag, Pet Bag, EVA Tote Bag Dongguan KangTa Plastic Hardware Products Co., Ltd. , https://www.evayes.com

The mobile payment service is not an ordinary value-added service, so its revenue cannot be simply calculated by the number of users × the unit price of the business. In this way, many experts will conclude that the business is losing money. Mobile phone payment spans the two major industries of telecommunications and finance. It is a new business with the ability to build an industrial chain. The business benefits are not only calculated from the business itself, but also the entire industry chain, brand influence, etc. The strategic height is assessed. Japanese operator NTT DoCoMo has spent huge sums of money to acquire part of the shares of Mitsui Sumitomo Financial Group, Japan's third-largest bank, and to acquire part of Mizuho Bank's shares, to promote mobile payment services through holding shares, and to stand in the mobile payment industry chain. The priority position can be seen in the importance of the business.

Therefore, domestic operators are not only competing with their peers, but also competing with the financial industry to develop mobile payment services. They are still competing with themselves. The operators who form the first scale application market will obtain the payment basic industry chain (or the first industry chain). The initiative has become the game rule maker of the extended application industry chain (second industry chain). This is where the gold mine of mobile payment is located and the key to the profit model.

First, the two industry chains of mobile payment

Mobile payment is destined to be a large audience's business. Its business form and business nature determine that the business only has a large user base. Mobile phone payment uses RFSIM technology to make large-scale applications very easy to imagine, and in the process of trial use, mobile phone payment and integration of existing IC cards such as subway, bus, and all kinds of cards have made mobile payment become It is a hot commodity. With the emergence of scale effects, two industrial chains have surfaced.

Mobile payment basic industry chain: This is the first industry chain of mobile payment, and all business related to payment and transaction belongs to the industrial chain. His core is convenient micropayments, such as common subway transportation, entertainment, catering, shops, electronic ticketing and other payment services. The form of the industrial chain is this: end users - banks (and their partners) - operators (and their partners) - merchants. The two ends of the industry chain are end users and merchants, and the middle is banks and operators, which further weakens the role of banks, so that operators will have the function of clearing settlements. Paying commissions and depositing funds is a core value in the industry chain.

Expanding the application industry chain: that is, the mobile phone payment second industry chain, including all services except mobile payment services, except for payment and transactions, especially based on merchants (enterprise) value-added services. RFSIM, a smart payment chip with communication function, can not only complete the payment function, but also complete the analysis and mining of payment transaction records through smart card partition storage, sub-level authentication, and more: you can do score cards, discount cards, Discount cards, authentication ID cards, access cards, VIP cards, membership cards, medical cards, livelihood cards, convenience cards, etc. The core of the industry chain is to help merchants (enterprise) marketing and cost savings, while bringing more convenience to end users. For example, loyalty cards, discount cards, etc. can allow merchants to conduct more effective and accurate marketing through the analysis of transactions, and other business cards such as membership cards will save users more cost-issuing, management, maintenance and other costs.

Second, the profit model guidelines

After a brief analysis of the two industry chains of mobile payment, the profit model of mobile payment is clear. Here, in order to avoid everyone focusing on the profit model of mobile payment, paying a commission, simply enumerate some of the main profit models.

1. Pay commissions and deposit funds

Paying commissions and depositing funds is the most intuitive profit model for mobile payment, and the core of the mobile phone payment industry chain.

Pay commission: According to different business realizations, the proportion of commissions is different. Take Hunan Mobile Mobile Payment Center as an example, with clear settlement function, so Ye has a competitive commission ratio. The commission for bank card swipe is generally around 1-2%. The commission distribution for offline payment is very small compared to the bank card swipe. Basically, it can be controlled by the operator (especially after the payment account is established). The commission ratio is higher than that of the UnionPay have more advantages. Therefore, it is possible to adjust the commission ratio (compared to bank card swipe) and the more convenient T+n fund transfer cycle. Obviously, the scale of payment is very important. It is necessary to make money through commissions. It also takes a certain period of time to cultivate the market. It is generally estimated that when the payment scale exceeds 100 million yuan, the break-even point of mobile payment single business will appear.

Precipitation funds: The funds deposited in the mobile payment account (including the unowned funds generated by the abandoned card) is a fortune. The more users, the longer the payment cycle of the merchant, the longer the payment cycle of the user, the more the deposit, the scale The more obvious the benefits, the obvious is reflected in Alipay (it is estimated that the deposited funds are about 500 million yuan), and the deposit of over 100 million yuan is not a small amount in terms of bank interest. Of course, this part of the income is usually reflected in the gray income. How to use and supervise this wealth is temporarily a vacuum, but the benefits that can be brought to the mobile phone payment are real.

2. The second industry chain

For the extended application chain, it is mainly a value-added service belonging to the merchant (enterprise), which can design an endless stream of innovative business, point business, member business, coupon business, marketing activity business, merchant relationship business, etc. Two types of profit models:

The first category is sales promotion for merchants (enterprise), which means that the business will increase the sales volume of the business (enterprise), such as through marketing activities, coupon business, through the mining of transaction records, through the business model. Analysis can help merchant marketing more accurately and effectively, thus driving sales of merchants. In addition to the cost of marketing is the cost, can bring marketing expenses for sales to the superior, the merchant is certainly willing to pay for this. Usually in the form of monthly subscription, according to the user capacity ladder, according to the marketing effect charging mode.

The second category is to save costs for merchants (enterprises), such as the use of membership business, point business, access control business, security certification business, etc., through the effect of hosted services, scale, saving the cost of business card making, card issuance, management, maintenance, etc. For small-scale, cost-sensitive businesses, there will be a larger market. Usually in the form of a monthly subscription, according to the user capacity ladder.

The profit model of the second industry chain, operators only need to formulate the rules of the game, similar to the Monternet management of value-added services, do a good job of information security, and provide services for expanding applications through partners, operators are basically sitting on the ground to collect money. In the long run from the payment of mobile phones, the value of the second industry chain is far greater than the value of the first industry chain.

3. Brand reputation and user bundle

The successful implementation of mobile payment has given the mobile phone a function outside the communication, which is convenient for the public to live, and will inevitably greatly enhance the reputation of the relevant brand of the operator. At the same time, mobile payment involves transactions and other extended services, and the user's sticky characteristics are obvious, which will provide strong guarantee for the operators' users to bundle in the network transfer, port number transfer, and card abandonment.

When mobile payment affects people's lives, it will be the silent marketing activities of operators, which is the highest level of social responsibility marketing. These cannot be measured by money.

Third, the ultimate concern for mobile payment

The reason why mobile payment is highly valued by the industry is that the profitability of the business itself is not mentioned. It is more because the two industry chains of mobile payment reflect its ultimate concern. They are the two ends of the industry chain: one realizes the public The convenience of the convenience of life, the second is to bring more revenue to the business care. In the same way, while we carry out this business, we will focus more on our goals and visions on these two ultimate concerns.

Mobile payment industry chain and profit model guidelines